Call William Directly at 248.980.2455

January Real Estate Market Update

December ended the year with strong momentum (our strongest month of the year seasonally adjusted), carrying about 20% more buyer interest into 2013 than we had going into 2012. Buyer demand will build as those who were forced to sell and rent are now coming back into the market to buy, along with stronger economic growth. An offset to that increase will be additional inventory as prices rise to meet the target home values many Sellers have been waiting for, as well as more investors begin to put their homes on the market.

In spite of an increase in homes for sale, we can expect an inventory shortage throughout 2013. Buyers will have to be more creative and will need to make some compromises in their home searches.

Ideally, you want to buy a home that will be the easiest to sell; updated, homogeneous design to the area, good schools, not too remote, etc. However, that is the same advice everyone is given, so those homes sell fast and they do sell for a premium. Nonetheless, if you can find one, buy it! With today’s prices, that premium still makes sense. That does not mean you should shy away from the less than perfect homes. In fact, that is where the best bargains lay, in those homes that need some work or are not in the perfect location. You will sell them for less than the “perfect” house, but you also may be able to buy them for a larger discount, so you may actually come out ahead from an investment standpoint.

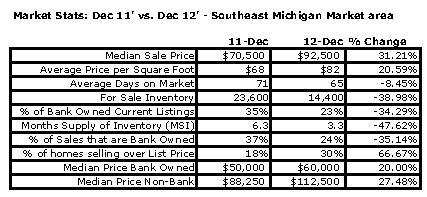

The market statistics tell the story of how far the market has moved since the end of 2011, with large double-digit positive changes in most categories.

It has been quite a ride, a big drop, followed by a big (though not as big) jump. With more reasonable lending standards and steady economic growth, we expect housing to remain strong and steady for the next five years or more, bringing us back to the peak levels we saw in 2006. The funny thing is if we had simply held to our traditional 2-3% per year value growth from 2000 on, rather than our wild ride down and up, we would hit the same projected values in 2018 as we will with our big drop and jump. This proves what statisticians always say, over time, every trend always reverts to the averages!