Call William Directly at 248.980.2455

October Real Estate Market Update

September activity was above expectation. We anticipated a slow down as the pent-up demand released along with the increased cost of housing (from rising interest rates and home prices). Instead, buyer interest remained strong with the pace of sales actually increasing with a portion being from buyers jumping in as the rates climb. Underneath that strong buyer activity the trends we have been noticing remain: new listings coming on the market are increasing and buyer demand, although very strong, is not growing as fast as it was. We are still holding to our prediction of moving to a more “normal” market, it just may be a few months later. This is great for home sellers but adds a bit of frustration for buyers in their home search.

The big question is, “How will both the government shut down and the treasury debt ceiling effect the housing market?” The answer is, so far, very little. The biggest concerns with the government shutdown are about mortgages, getting IRS certifications for buyers and FHA staffing for approvals. Since the government buys 80% of all mortgages, it’s easy to wonder, “Who is buying them?” From our experience at John Adams Mortgage, we have been able to work around all of these issues, and with a little bit of extra effort, fund both conventional and government loans. The only loans that have been affected are Rural Development Loans (RD’s), which are not able to be funded unless the commitment was issued prior to October 1st, 2013. If the shutdown continues into months then we will begin to see a temporary slowdown in mortgages and the housing market in general. The debt ceiling is much more significant. Without it lifting, the treasury will not be able to borrow, which will make a significant impact on housing and the entire economy (how much is hard to tell since the government provides those stats and they, of course, are not around). For that reason, few expect the debt ceiling to be an issue, and tied to that will be the end of the shutdown or at least a partial end.

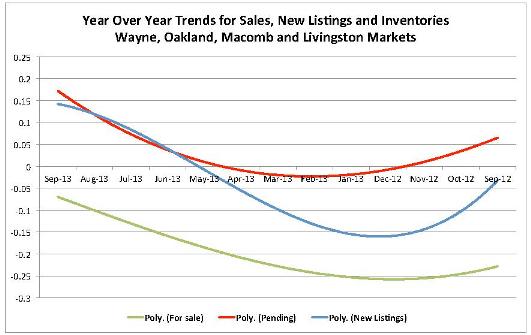

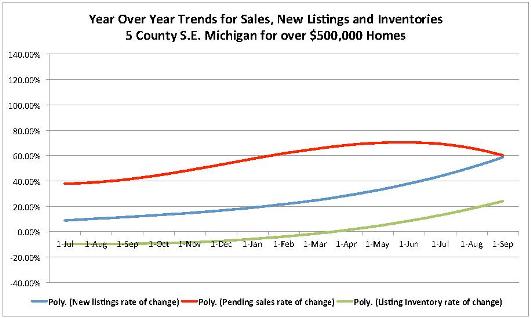

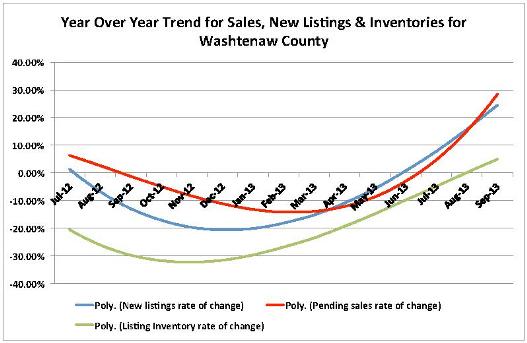

The charts below are an update from the August report, confirming the continued trend of an increase in new listings entering the market each month, across all price ranges and markets. Parallel to that is a continued increase in home sales, eating up those new listings as they enter the market (55% of new listings are being sold in under 30 days in SE Michigan).

For both properties over $500,000 in the metro area as well as for all of Washtenaw County, the number of homes on the market has begun to increase on a seasonally adjusted basis. The same is happening for sales, however the trend is still pointing to enough new properties hitting the market over the next 3-4 months to begin to relieve some of the inventory shortage crisis (in all counties and price ranges).

About William Brundage – Max Broock Realtors:

Named the Best Realtor by the Oakland Press, William Brundage is an industry leading Realtor bringing over twenty years of experience to successfully marketing and selling fine homes and estates. His dedication to his clients places him in the top 1% nationwide. Personalized service and client satisfaction are paramount. William is committed to getting you the best price and terms in the shortest amount of time.

Cell: 248-980-2455

Email: william@williambrundage.com

Website: www.WilliamBrundage.com