Call William Directly at 248.980.2455

December Real Estate Market Update

The rate of sales slowed in November as it has for the prior three months. It is still strong, but not as strong as this time last year. Inventories continue to fall as a result of an increasing number of listings that are expiring. New listings entering the market have been up for the past six months. Many of those are expired listings reentering the market, which are not enough to raise inventories. For buyers, there is still a significant shortage of available homes for sale with inventories remaining at 10-year lows. At the end of November, Southeast Michigan inventories dropped below 10,000 properties (this is compared to the peak of over 65,000 properties for sale in 2008). Values are up about 8% and new listings entering the market continue to rise. This shows that sellers are seeing some light at the end of the value tunnel and are putting their homes on the market at an increasing rate.

There are more than a few people predicting a flat to declining real estate year for 2014. Certainly with the possibility of tougher mortgage standards, rising interest rates, pent up demand having been released and a relatively flat economic growth, it is reasonable to predict a slow down. After all, we can’t expect to have record years every year (in terms of unit sales) and three years in a row is a pretty good run. We do think 2014 will not be as strong as 2013, but I am more optimistic than most, mainly because there is still quite a bit of buying power left in the market.

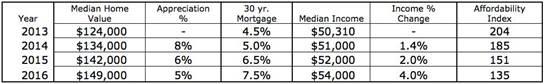

The housing affordability index is a good measure of that buying power. Historically, an index in the 120 range (the median family income can buy 120% of the median priced home) is the good spot for a balanced and healthy housing market. In Michigan, we might move that range up to 140 since our values tend to be lower. We are still over 200 in Michigan, so there is still some buyer “slack” that will be capable of pushing up prices and creating multiple offers into 2014/15 (but not at the same pace as 2012/13). The chart below gives an example of what the index would look like given reasonable assumptions for the next few years.

If these assumptions hold, the market will settle to a balance around 2016. There is a positive wild card and that is household income. Income growth has been flat, which does not help home values. But as jobs grow and second income opportunities increase, this supercharges a household’s buying power. Although the median income may not be rising quickly, every job that creates a strong second income, also creates powerful homebuyers who can buy/outbid a significantly higher priced home.

A Short Spotlight on the City of Detroit: The city certainly suffered more than most in the downturn, but its rise has also led the way up. Since 2011, the median price has risen 89% and the average price 69%. Sales are still dominated by investors at the lower end of the market causing the median price to hover around $13,000. Looking behind those numbers we see some strong trends comparing 2013 to 2011. Sales of homes in excess of $40,000 have risen 20% and homes in excess of $100,000 have risen 61%. This shows that with more higher value sales, owners are moving in to replace investors. Midtown and Downtown have a housing shortage as well as key neighborhoods such as Rosedale, University, East English and many more.

As prices and interest rates rise, watch for some of the lower priced areas to heat up even more (Livonia, Redford, East Ferndale, Warren, Detroit, Taylor, Westland, etc.) as buyers move down in value, rather than leave the market altogether.

We had a strong November in buyer activity and sales, bringing some nice momentum into the New Year.

About William Brundage – Max Broock Realtors:

Named the Best Realtor by the Oakland Press, William Brundage is an industry leading Realtor bringing over twenty years of experience to successfully marketing and selling fine homes and estates. His dedication to his clients places him in the top 1% nationwide. Personalized service and client satisfaction are paramount. William is committed to getting you the best price and terms in the shortest amount of time.

Cell: 248-980-2455

Email: william@williambrundage.com

Website: www.WilliamBrundage.com